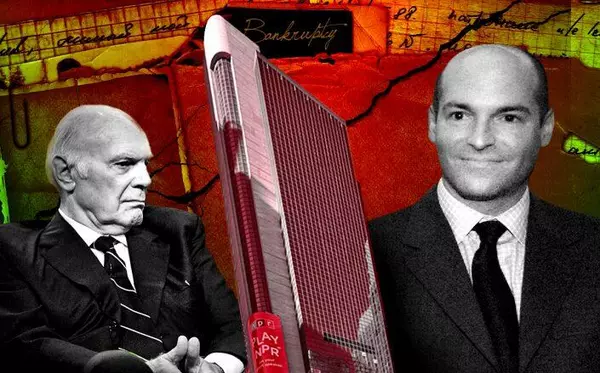

Blackstone, Starwood REITs draw SEC’s attention after limiting withdrawals

Moves by Steve Schwarzman’s Blackstone Group and Barry Sternlicht’s Starwood Capital to limit investor withdrawals from their respective real estate investment trusts amid an uptick in requests has caught the attention of federal regulators. The Securities and Exchange Commission has reached out to both firms to understand the market impact and circumstances of the decisions, Bloomberg reported, citing anonymous sources. The SEC has reportedly inquired about how Blackstone and Starwood met redemptions and whether any of the companies’ affiliates had sold before clients. The outreach by federal regulators doesn’t mean either firm is under investigation or suspected of any wrongdoing. The increase in withdrawal requests has drawn attention to the packaging of assets like real estate into funds that offer cash back when investors want. However, limits are put on how much an investor can withdraw in order to prevent a quick selloff of assets. But those limits can also force funds to restrict withdrawals, which can hamper investor confidence at a time when higher interest rates have slowed commercial real estate markets. The increased scrutiny comes as private equity firms have welcomed an influx of new capital from smaller investors into their respective retail funds. It’s now drawn a closer look from investors, regulators and the public about the mechanics of a real estate investment trust. A Blackstone spokesperson told Bloomberg that “our business is built on business, not fund flows, and performance is rock solid.” Blackstone, Starwood and the SEC declined to comment to the publication about the inquiries.

Brooklyn hotel converted into supportive housing

Challenging times call for creative solutions. To wit: a 30-story former Jehovah’s Witness hotel in Brooklyn has been converted to one of the nation’s largest supportive housing developments, according to the New York Times. The building at 90 Sands Street in Dumbo — which has 490 units, along with a gym, computer lab and bike room — will have 385 formerly homeless tenants who will pay no more than 30 percent of their income in rent, and another 105 rent-restricted tenants who will pay between $540 and $2,130 per month for studio and one-bedroom apartments. There are also on-site mental health and support services. The developer, Breaking Ground, purchased the building from RFR Realty for $170 million in 2018. The need for affordable housing in the city and nationwide has been well documented. In New York City, there are about 68,000 unhoused people, according to one 2021 survey, though advocates say that could be a significant undercount, the outlet reported. Mayor Eric Adams said another 25,000 hotel rooms could be converted into affordable or rent-free units. However, significant obstacles, including zoning restrictions and union opposition, have prevented any conversions other than the one in Dumbo from taking place since the start of the pandemic, the Times reported. Adams recently announced a plan to help spur residential building as well as remove zoning restrictions to allow for more supportive housing. On Thursday, City Council Speaker Adrienne Adams announced a housing and land use agenda that includes affordable housing goals for each community district. Converting hotel units to provide shelter to unhoused people isn’t unique to New York City. In Albuquerque, New Mexico, plans were recently unveiled to convert hotels and motels into housing for at least 1,000 unhoused and lower income people, the Albuquerque Journal reported..In Hartford, Connecticut, a former Days Inn was recently converted into a men’s shelter for more than 50 residents, according to the Hartford Courant. So far there are about 160 residents who have moved into 90 Sands in Brooklyn. “This is why I’m alive,” resident George Karatzidis, who became homeless in 2009, told the Times. “It’s like I’m reborn.”

MV Realty accused of scamming homeowners

A Florida-based real estate company has been sued by the Massachusetts and Pennsylvania attorneys general for allegedly scamming financially struggling homeowners, the Philadelphia Inquirer and CBS Boston reported. MV Realty is accused in both states of misleading homeowners by obtaining mortgages on their homes without their knowledge, the outlets said. The company, according to the lawsuits, paid homeowners a few hundred dollars in exchange for the right to be the listing agent in the event a homeowner decided to sell their home. MV Realty, under the 40-year contracts, would receive money if the company sold the property, the homeowner canceled the agreement or if the property was transferred in some other way, including foreclosure or a transfer when the owner dies, the Inquirer reported. The contracts also allegedly permitted MV Realty to obtain mortgages on the homes, unbeknownst to the homeowners. “I was shocked,” Philadelphia homeowner Timothy Calhoun, who entered into a contract with MV Realty, said at a hearing, the Inquirer reported. “They never told me that I was signing a mortgage. If I had known that I was gonna put a mortgage on my house, I would have never had signed the agreement.” Calhoun, who claimed he was surprised when he received notice that MV Realty had taken out a mortgage on his home, said he was told he could pay more than $6,000 to get out of the agreement. A Massachusetts homeowner said she had to pay two real estate commissions on a property she sold because she allegedly unknowingly signed a 40-year agreement with MV Realty. The Pennsylvania attorney general’s office estimates there are about 1,000 mortgages involving MV Realty in the commonwealth, while the company says it has 550 “client relationships” in Massachusetts. MV Realty, which operates in 33 states nationwide and has also been sued by the Florida attorney general, denied it engaged in any false or deceptive practices. “We are confident that after a full airing of the facts, the conclusion will be that MV Realty’s business transactions are legal and ethical and that our team has operated in full compliance with [Massachusetts] law,” the firm said in a statement to CBS Boston. The company issued a similar statement to the Inquirer.

Categories

Recent Posts