Blackstone, Starwood REITs draw SEC’s attention after limiting withdrawals

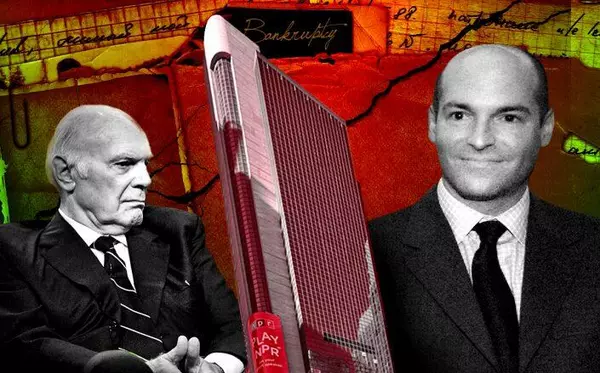

Moves by Steve Schwarzman’s Blackstone Group and Barry Sternlicht’s Starwood Capital to limit investor withdrawals from their respective real estate investment trusts amid an uptick in requests has caught the attention of federal regulators.

The Securities and Exchange Commission has reached out to both firms to understand the market impact and circumstances of the decisions, Bloomberg reported, citing anonymous sources. The SEC has reportedly inquired about how Blackstone and Starwood met redemptions and whether any of the companies’ affiliates had sold before clients.

The outreach by federal regulators doesn’t mean either firm is under investigation or suspected of any wrongdoing.

The increase in withdrawal requests has drawn attention to the packaging of assets like real estate into funds that offer cash back when investors want. However, limits are put on how much an investor can withdraw in order to prevent a quick selloff of assets.

But those limits can also force funds to restrict withdrawals, which can hamper investor confidence at a time when higher interest rates have slowed commercial real estate markets.

The increased scrutiny comes as private equity firms have welcomed an influx of new capital from smaller investors into their respective retail funds. It’s now drawn a closer look from investors, regulators and the public about the mechanics of a real estate investment trust.

A Blackstone spokesperson told Bloomberg that “our business is built on business, not fund flows, and performance is rock solid.”

Blackstone, Starwood and the SEC declined to comment to the publication about the inquiries.

Categories

Recent Posts

GET MORE INFORMATION