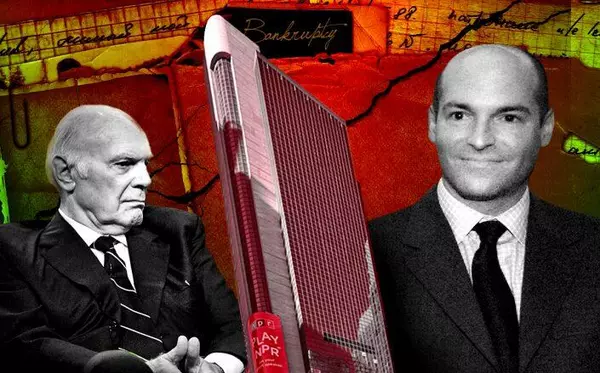

Vornado gets booted from S&P 500

The city’s second-largest commercial landlord is starting the year with some bad news.

Vornado Realty Trust cut its dividend by nearly 30 percent after the markets closed on Wednesday, Crain’s reported. The economic downturn and rising interest rates were to blame, according to the real estate investment trust, as well as an estimate on how much taxable income will fall this year.

Separately, the firm was also booted from the S&P 500 this month. The stock was removed on Jan. 4 because shares became “more representative of the midcap market space,” S&P disclosed. The demotion frees index funds tracking the S&P 500 from holding the stock.

The dividend slash was not unexpected. During the firm’s third quarter earnings call, chairman Steve Roth said the board would “right-size dividends” because payouts were based on taxable income. The size of the cut, however, has taken some by surprise.

“The dividend cut has us second-guessing growth this year,” Evercore ISI analyst Steve Sakwa wrote in a client report; he projected a 10 percent cut. The move is expected to save Vornado $30 million this quarter.

Roth’s efforts to pump up the stocks during the aforementioned earnings call appears to have been in vain, though. At the time, Roth said REIT office stocks were “stupid cheap” and bound to recover eventually.

Vornado’s stock has lost two-thirds of its pre-pandemic value.

Nearly three years into the pandemic, some office landlords and developers are acknowledging that things will never return to the old normal. Many are trying to diversify their portfolios as much as possible; Empire State Realty Trust, Boston Properties and Silverstein Properties are among those leaning into the multifamily market, for instance.

This month, office landlord New York City REIT bailed on its trust status and moved towards diversifying its portfolio, both beyond the Big Apple and past the recovering office landscape, which chief executive officer Michael Weil acknowledged “remains challenged.”

Categories

Recent Posts

GET MORE INFORMATION