Home sales’ November decline was largest in 10 years

The evidence keeps pouring in: Fewer sales. More days on the market. Fewer bidding wars. Fewer offers above the asking price. Yes, the housing market is continuing its about-face. Home sales dropped 35.1 percent year-over-year in November, according to Redfin — the largest drop recorded by the broke

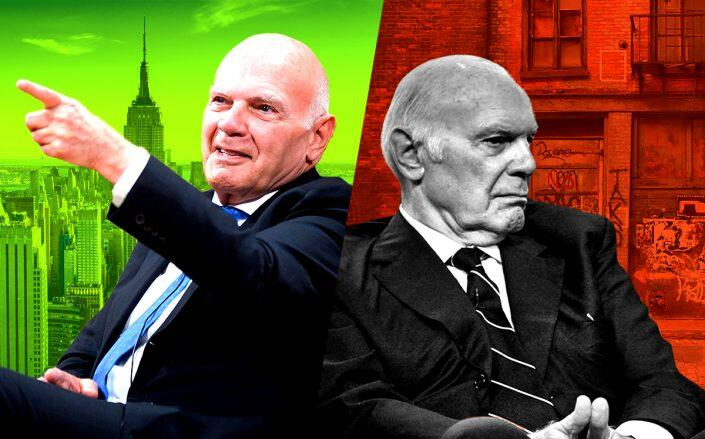

RXR abandons plan for $345M proptech SPAC

One group of proptech investors is getting a refund before the holidays. After nearly two years, Scott Rechler’s RXR has pulled the plug on plans for a SPAC to merge with a proptech company and will return $345 million to would-be shareholders. RXR Acquisition Corp. will cancel its public shares on

Eric Adams eyes big changes for Fifth Avenue corridor

Adams announced a “major new visioning process” to make Fifth Avenue between Bryant Park and Central Park more pedestrian friendly, Gothamist reported. The mayor called the plan for the stretch from around 42nd to 59th streets an “unmissable opportunity” to “help create vibrant central business dist

Categories

Recent Posts