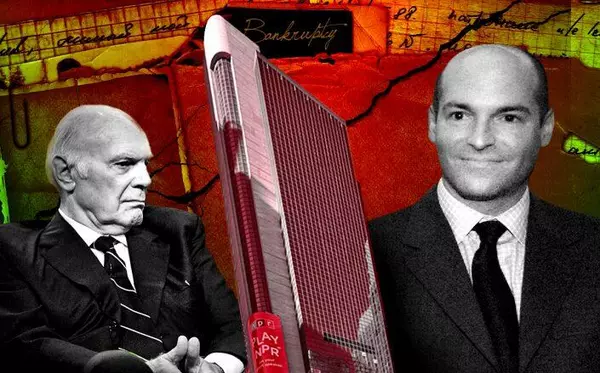

RXR abandons plan for $345M proptech SPAC

One group of proptech investors is getting a refund before the holidays.

After nearly two years, Scott Rechler’s RXR has pulled the plug on plans for a SPAC to merge with a proptech company and will return $345 million to would-be shareholders.

RXR Acquisition Corp. will cancel its public shares on Dec. 20, ahead of the March 8 deadline to either merge with a target company, or return shareholders’ investment, the company disclosed in a filing with the Securities and Exchange Commission.

The real estate firm framed the outcome as a positive, saying it had resisted acquiring startups that seemed promising but whose valuations subsequently collapsed.

Last week, a shareholder vote expedited the liquidation of RXR’s special purpose acquisition company, which had searched for a proptech company to turn into a publicly traded company.

An RXR spokesperson said by email that it had “several opportunities to acquire various startups with strong business models and momentum,” but considered their valuations to be too high.

“RXR will continue investing in and partnering with innovative protech companies,” the spokesperson said.

The developer and landlord is an investor in the parking startup Metropolis, lease management platform VTS, ghost kitchen startup Kitchen United, office management firm Eden and smart-glass maker View.

Shareholders whose funds are held in RXR Acquisition’s trust account “will not need to take any action in order to receive the redemption amount” of $10 per share, according to a company press release.

The company’s investors may be glad no merger took place. The stock prices of various proptech startups have fallen dramatically Opendoor stock is down 90 percent this year. Digital title insurer Doma recently laid off 40 percent of its workforce.

RXR’s SPAC proptech reversal is not the first. Last summer, the Chera family failed to raise enough cash to merge with proptech firm Brivo.

For a time, however, there was plenty of enthusiasm. After RXR Realty, which controls 26 million square feet of office space in New York City, announced in early 2021 that it would seek $250 million for a SPAC, that amount grew to $345 million.

While SPACs have largely fallen out of favor and many proptech startups have struggled this year, some investors still have an appetite for the sector. Venture capital firm Fifth Wall recently announced it had raised $866 million for its latest proptech fund, the largest-ever dedicated venture fund of its kind.

Categories

Recent Posts

GET MORE INFORMATION