Is There More Caffeine in Espresso Than in Coffee?

If you’re feeling especially groggy in the morning, you might decide to opt for the jolt of a shot of espresso in place of your usual cup of coffee. The aromatic brew is known for having an extra kick that may help start your day. But does espresso really have a bigger dose of caffeine than what’s in a cup of regular coffee? Tallying the Caffeine The answer depends on how much of each beverage you’re drinking. Espresso typically has 63 mg of caffeine in 1 ounce (the amount in one shot), according to Department of Agriculture nutrition data. Regular coffee, by contrast, has 12 to 16 mg of caffeine in every ounce, on average. That means that ounce for ounce, espresso has more caffeine. But who stops at 1 ounce of coffee? A more common scenario is downing at least eight times that much. If you drink 8 ounces of your home brew, you’re getting 96 to 128 mg of caffeine. Those numbers are simply the USDA’s standard estimates, however. Complicating matters is that a number of factors can further vary the caffeine counts for both espresso and coffee. These include the brand, the type of bean, the type of roast, the amount of coffee used to make a cup, and the way it’s prepared (brewed, French press, cold brewed, espresso machine, etc.). At Starbucks, for example, a single shot of espresso—which, for the coffee giant, measures 0.75 ounces—has 75 mg of caffeine. An 8-ounce cup of Starbucks’ Pike Place medium-roast coffee has 155 mg. So why do we feel as if espresso delivers a bigger jolt than a regular cup of coffee? Stephen Schulman, who has worked in a variety of roles in the coffee industry for more than 35 years, says it may have to do with how quickly you down each beverage. The small serving size of an espresso means that you drink it faster than you would a cup of coffee, which you typically sip more slowly. Espresso can actually be a good option if you’re looking to cut down your caffeine intake, as long as you limit the amount to one shot. You can enjoy the espresso in the Italian fashion and drink it on its own, or if you’re looking to linger over your beverage, order an espresso-based drink such as a cappuccino or latte.

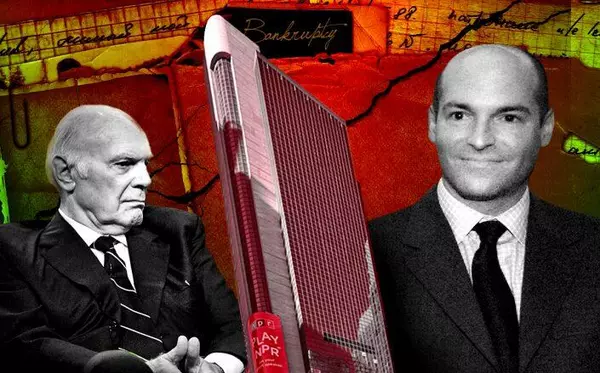

Vornado gets booted from S&P 500

The city’s second-largest commercial landlord is starting the year with some bad news. Vornado Realty Trust cut its dividend by nearly 30 percent after the markets closed on Wednesday, Crain’s reported. The economic downturn and rising interest rates were to blame, according to the real estate investment trust, as well as an estimate on how much taxable income will fall this year. Separately, the firm was also booted from the S&P 500 this month. The stock was removed on Jan. 4 because shares became “more representative of the midcap market space,” S&P disclosed. The demotion frees index funds tracking the S&P 500 from holding the stock. The dividend slash was not unexpected. During the firm’s third quarter earnings call, chairman Steve Roth said the board would “right-size dividends” because payouts were based on taxable income. The size of the cut, however, has taken some by surprise. “The dividend cut has us second-guessing growth this year,” Evercore ISI analyst Steve Sakwa wrote in a client report; he projected a 10 percent cut. The move is expected to save Vornado $30 million this quarter. Roth’s efforts to pump up the stocks during the aforementioned earnings call appears to have been in vain, though. At the time, Roth said REIT office stocks were “stupid cheap” and bound to recover eventually. Vornado’s stock has lost two-thirds of its pre-pandemic value. Nearly three years into the pandemic, some office landlords and developers are acknowledging that things will never return to the old normal. Many are trying to diversify their portfolios as much as possible; Empire State Realty Trust, Boston Properties and Silverstein Properties are among those leaning into the multifamily market, for instance. This month, office landlord New York City REIT bailed on its trust status and moved towards diversifying its portfolio, both beyond the Big Apple and past the recovering office landscape, which chief executive officer Michael Weil acknowledged “remains challenged.”

These were the top residential brokerage stories of 2022

Residential brokerages fall back to Earth in 2022, and made some momentous moves along the way. After a decade of ruthless expansion that saw it become the largest brokerage by volume, Compass shifted its focus to profitability, as questions swirled about its financial health. There were several high-level shakeups across the industry, as brokerages said goodbye to C-Suite executives in an effort to streamline their operations. None were as big as Coldwell Banker CEO Ryan Gorman’s departure from the Anywhere subsidiary, a move that brought Anywhere’s leased and owned brokerages under the supervision of a single executive. Several brokerages joined forces in an attempt to keep up with the big fish, including Level Group joining Oxford Group, and The Agency acquiring Triplemint. Berkshire Hathaway Home Services, a major player nationally but a small fish locally, started its play to rise through New York City’s residential brokerage ranks by reintroducing longtime Douglas Elliman executives Steven James and Brad Loe, which Berkhsire poached last year. Here are the biggest residential brokerage stories of 2022: The Agency acquires Triplemint for NYC debut The Agency and Triplemint joined forces in May, after months of speculation that a deal was imminent. The deal gave The Agency, a Los Angeles based firm, a foothold in New York City, and saw Triplemint founders David Walker and Philip Lang stay on as chief strategic officer and chief business officer at The Agency. The financials of the deal were not disclosed. Triplemint’s staff of over 75 software engineers, data scientists, marketers and strategists, as well as their 250 agents, joined The Agency’s in-house teams and agent roster of over 1,000. Triplemint, home to “Million Dollar Listing New York” star Tyler Whitman, had been on a growth spurt in recent years, opening three new offices in the tri-state area last year on the heels of expansions to New Jersey, Westchester County and the Hamptons. Oxford Property Group and Level Group joining forces Less than two months after The Agency took over Triplemint, Oxford Property Group and Level Group, two of the largest 100-percent-commission firms in New York City, announced a merger of their own. The merger, which created Oxford-Spire-Level, brought the number of brokers working under the Oxford umbrella to nearly 1,000, with the vast majority of them operating in the New York City area. Last year, Level Group ranked as The Real Deal’s 22nd largest NYC brokerage by sales volume, and Oxford ranked tied for 24th. The merger made Oxford-Spire-Level the sixth largest New York firm by headcount, with 814 brokers, according to data collected by The Real Deal. “We’re actively on the hunt for other companies,” said Larry Link, Level Group co-founder and president. Link stayed on as president of Oxford-Level-Spire. Link said the merger was first discussed in 2016 but set aside while he and Level Group co-founder Michael Greenberg grew the development side of the company. Greenberg’s death in 2021 was one of several factors that led to the merger happening this year. Another was the calculation that greater scale would equate to greater agent support. The 100-percent-commission model allows brokers to pay a $495 monthly fee and in exchange keep all of their commissions, or pay $99 per month and pay a 10 percent split with the brokerage. Berkshire Hathaway HomeServices wants to be a New York contender The past year saw the return of two big-name Douglas Elliman executives to the New York City market — but this time with Berkshire Hathaway. Steven James and Brad Loe jumped to Berkshire in 2021 but had to wait out the year-long non-compete in their Elliman contracts. With that out of the way, Loe and James took the reins of Berkshire Hathaway HomeServices New York Properties with the aim of beefing up the firm’s headcount and sales volume. By July, the pair had recruited 17 brokers from Elliman, including Cynthia Jacinta Keskinkaya, a broker ranked in Elliman’s top 75 in Manhattan. They weren’t on pace to make their stated recruitment goal of 125 by the end of the year, but aim to have 150-200 brokers by the end of 2023 spread across four offices. James and Loe said they’re betting that an old-fashioned, shoe-leather approach to recruitment will top a glitzy pitch about technology. “We’re not looking for vast numbers for numbers’ sake, we want people of quality that want to grow their business and that want to be part of a culture,” James said. “We’re going back to the old method of really working closely with your agent staff and team.” Compass loses $101M; will no longer offer equity to new agents The steep losses revealed in Compass’ second quarter earnings were down from the first quarter, but marked big news as the brokerage announced the end of its agent equity program and a cost reduction program. The call represented a watershed moment for Compass, as it abandoned its aggressive growth strategy and for the first time aimed for profitability as a result of its biggest backer, Softbank, experiencing financial troubles due in-part to WeWork’s collapse. Compass announced a $320 million cost reduction program during the call and initiated two rounds of layoffs shortly after in which it laid off 800 tech employees, including its chief technology officer. The company said the jobs were no longer needed as a result of Compass completing its $900 million tech platform. All of this transpired without a CFO, as roughly three months — an unusually long time for a publicly traded firm — passed before Compass announced Kalani Reelitz would take over for Kristen Ankerbrandt, who left in September. But there are reasons for optimism: Compass’ stock rallied after its third quarter earnings call, during which it revealed more losses but growing market share. And if it can maintain its current revenue while executing the rest of its cost reduction strategy, it’ll hit the black. Ryan Gorman out as Coldwell Banker CEO Anywhere earlier this month announced Ryan Gorman’s 18-year tenure with the firm will end after the first quarter of 2023. Anywhere said the decision was made to streamline operations: Gorman oversaw Coldwell Banker, the real estate conglomerate’s owned franchise, while Sue Yannaccone oversaw the firm’s franchised brands. Now, Yannaccone will oversee both, eliminating Gorman’s $3.5 million compensation package. The circumstances around Gorman’s departure remain unclear, as the executive has been active on the media circuit and is slated to speak at an Inman event in January. Gorman, who was tapped to head Coldwell Banker in 2020, oversaw 100,000 agents across nearly 3,000 offices worldwide. He also oversaw the acquisition of Frederick Peters’ Warburg Realty, one of the last independent brokerages in the city.

Categories

Recent Posts