Housing affordability is worst on record, data shows

Housing affordability nationwide is the worst it has ever been on record due to spiking home prices and interest rates, Bloomberg reports. The crisis has reached areas of the country that once had the most affordable homes, the outlet reported citing data from the Federal Reserve Bank of Atlanta. In September 2022, a median-income household would have had to spend a little over 46 percent of its income to afford a median-priced home. That’s a 14-point spike from September 2021, when a household had to spend about a third of its income to afford a home in its community. (The data measured affordability based on the ability of a median-income household to absorb the estimated annual costs associated with owning a median-priced home, including mortgage, estimated taxes and the cost of insurance.) Furthermore, in all but one U.S. metro area with more than 500,000 people, a median-income household would have to spend more than 30 percent of its income to own a median-priced home. The five least-affordable metro areas in the U.S. are all in California — Los Angeles-Long Beach-Anaheim, San Francisco-Oakland-Hayward, San Jose-Sunnyvale-Santa Clara, Oxnard-Thousand Oaks-Ventura, and San Diego-Carlsbad – and require a median-income household to spend at least 80 percent of its income to afford a median-priced home. The sixth-least affordable metro area is New York-Newark-Jersey City, which requires a median-income household ($86,000) to spend 66 percent of its income to purchase a median-priced home of $621,000. While the issues in those areas are well-known, some of the sharpest declines in affordability, according to Bloomberg, have been seen in the Southeast in cities such as Nashville, Atlanta, Tampa and Orlando. Just one metro area – Toledo, Ohio – rated above the affordability index, according to the data. Rounding out the top-five most affordable metro areas are St. Louis, Mo-IL; Des Moines, Iowa; Scranton-Wilkes Barre-Hazelton, Pa.; and Dayton, Ohio. Experts are predicting a market correction, where home prices fall more in line with income levels, the outlet reported. But, at this point, inventory of unsold homes hasn’t increased to the point where housing prices will see “We don’t know necessarily how it’s going to play out,” Domonic Purviance, of the Atlanta Fed, told Bloomberg. — Ted Glanzer

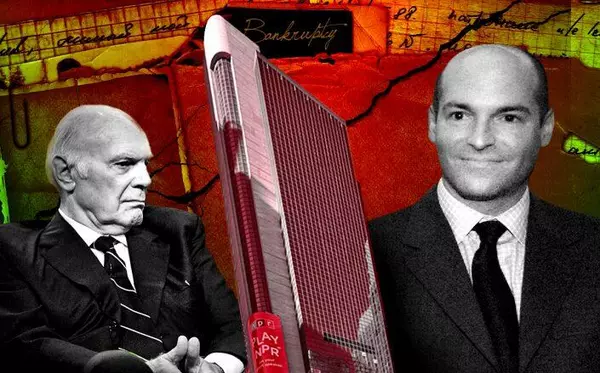

Who’s crazy enough to build office?

When 175 Park Avenue is complete, it will rise 1,575 feet, second only to One World Trade Center among New York City’s tallest towers. It is a statement in more ways than one: As companies shrink their office footprints and reduce headcount, developers RXR and TF Cornerstone remain confident that the quality of their project and its location beside Grand Central Terminal will fill its 2.1 million square feet of office space. “It checks every box that can be checked,” said RXR CEO Scott Rechler. RXR is not alone in pursuing massive, ground-up office projects despite workplace attendance stalling at under 50 percent and high borrowing costs slowing the economy. More such developments are planned for areas such as Hudson Yards and Midtown East, transit-rich neighborhoods where new and renovated office buildings have become poster children for the so-called “flight to quality.” The projects are widening the gap between modern, amenity-rich office space and increasingly vacant Class B and C properties. At the same time, some developers are pumping the brakes on office projects, given the now-apparent permanence of remote work, not to mention rising construction costs and interest rates, and troubles in the tech and financial industries. But the builders moving forward with office developments are banking on demand from tenants willing to pay a premium for flashy, classy space. “It is a very consistent story that new is outperforming old,” said Daniel Ismail, an office analyst for Green Street. “It is just the matter of, will the rents be there?” One Vandy hopefuls RXR and TF Cornerstone have ambitious goals for their Park Avenue project: Rechler said they hope to secure an anchor tenant and construction financing by the end of the year and to begin clearing the site in late 2023. He said they are in conversations with prospective tenants who have leases expiring in 2029 or 2030, near the expected delivery date of 175 Park. He has seen a drop-off in interest from tech companies this fall, but said financial services, media and law firms remain active. Financial services have accounted for 40 percent of Manhattan office leasing this year, according to Cushman & Wakefield. Rechler declined to share rent targets for the tower but said they would be comparable to One Vanderbilt, where SL Green Realty is asking for more than $100 per square foot on the lower floors and nearly three times as much higher up. It has already signed a tenant for its top rentable floor, which was asking an astonishing $322 per square foot. The massive new Midtown East tower, which is also next to Grand Central, signed a slew of tenants during the pandemic and is reportedly 95 percent leased, reinforcing Rechler’s optimism. “This is a great validation for the fact that companies want high-quality space,” he said. Many of the new office towers planned for New York City are in Midtown and within walking distance of a transit hub. Some projects have been in the works for several years and only recently secured city approval, while others are making their way through the approval process. Many are at least a few years away from going vertical and may be able to wait out the worst of a downturn. In August, Boston Properties filed a permit application for 343 Madison Avenue, where the company is building a 1,000-plus-foot office tower. A two-minute walk from Grand Central, it is in the early stages of construction and should be done by 2026, according to New York YIMBY. Boston Properties told the Wall Street Journal that it is sticking with its plans for another new office project in San Jose, California, believing market conditions will improve. The real estate investment trust declined to comment on the Madison Avenue project to TRD. Within a week of opening its 3 million-square-foot 50 Hudson Yards, Related Companies filed plans for another office building at 514 West 36th Street. However, it has not released a timeline for the project. At 415 Madison Avenue, Rudin Management is demolishing a 24-story building to make way for a 342,000-square-foot, 40-story office tower. Bill Rudin, the chief executive, predicted last month that although companies are shedding office space now, they will reverse course when the economy recovers. Meanwhile, Tishman Speyer is seeking zoning changes to make way for 99 Hudson Boulevard, another 1.3 million-square-foot office tower in Hudson Yards. The developer is nearly done with a 2.85 million-square-foot office property nearby, dubbed the Spiral, where Pfizer, Debevoise & Plimpton, HSBC, AllianceBernstein and two other tenants have leased nearly 2 million square feet. Asking rents reportedly ranged from $110 to $225 per square foot. Vanbarton Group took control of 3 West 29th Street last year and is redesigning an office tower planned for the site, originally slated for a condo project. Leasing activity in high-quality office buildings helps explain the confidence shown by developers making such bets. A majority of leasing is in new development and existing Class A or trophy properties within walking distance of transit hubs, offering a slew of amenities and featuring grand lobbies akin to those at luxury hotels, said JLL’s Jeff Eckert. “Assets that check all those boxes, those are the ones that are winning the day,” he said. Scaling back Since the pandemic began, buildings constructed since 2015 have been responsible for 100 percent of net absorption in the U.S., according to an analysis by JLL. Eckert acknowledged that market headwinds will cause some developers to pause, but he said it will be a “temporary blip.” That blip is already evident. According to the New York Building Congress, which advocates for the construction industry, only 33.6 million square feet of nonresidential development — which includes office, hotel, retail and other commercial space — will be built in New York City this year. The group forecasts only slight increases in the next two. That’s more than a third off the pace of pre-pandemic 2019, when 51 million square feet went up. Ten months before the pandemic, Vornado Realty Trust and Rudin revealed plans for a 1,450-foot-tall office tower at 350 Park Avenue. In June, the developers were in conversation with Ken Griffin about his investment firm, Citadel, potentially anchoring the tower. Vornado has since raised doubts about the timing of its projects. “I must say, the headwinds and the current environment are not at all conducive to ground-up development,” Vornado CEO Steve Roth said on the real estate investment trust’s third-quarter earnings call. Despite Roth’s ominous comments, Vornado says it is “100 percent committed” to building towers in the area surrounding Penn Station. State officials have similarly said the plans are “designed to withstand temporary market adjustments” and are moving ahead. Technical difficulties Silicon Valley giants were among the first employers to mandate that workers return to the office, at least part-time, as pandemic restrictions were lifted. But they repeatedly backed off as variants spiked Covid rates and employees came to treasure working remotely. Companies across the sector have since been pressured by investors to cut costs and are downsizing their footprints and laying off thousands of workers. Facebook parent Meta announced it would cut 11,000 jobs and spend at least $2.9 billion consolidating its office space, including by terminating leases. Amazon, which plans to lay off 10,000, reportedly halted plans for five new office buildings in Washington state and a sixth in Tennessee. Twitter, which just laid off half its staff, began shedding office space earlier this year. Green Street’s Ismail noted that deep-pocketed companies drive demand for high-quality office space, so consolidation within the tech sector is a major concern for the office market. “I think it is harder to sign a big office lease, and commit to 10-plus years of an office lease, when the economics are so uncertain,” he said. The technology sector accounted for 20.5 percent of U.S. office leasing last year, according to CBRE. Tech companies are now trying to sublease some 30 million square feet, up from 9.5 million square feet in the fourth quarter of 2019, the Journal reported, citing CBRE data. Meta abandoned plans to occupy an entire Austin building and aims to put its 589,000 square feet up for sublease. Tech firms are not the only ones downsizing. Law firms signed leases for just 500,000 square feet in New York during the third quarter, versus 800,000 during the same period last year, a Savills analysis found. Investment firm KKR recently canceled plans to take 300,000 square feet at a postal facility newly redeveloped by Tishman Speyer, according to Insider. New office construction was primarily responsible for the average starting rents in Manhattan, Queens and Brooklyn increasing 9.9 percent since the fourth quarter of 2019, according to CompStak. Half of that increase came from buildings recently constructed, such as One Vanderbilt, or substantially renovated. Take out trophy properties, such as 375 Park Avenue, and the gain was just 4.7 percent, according to CompStak. But the official dollar figures don’t reflect discounts, and landlords of new construction and trophy assets are “still doling out significant concession packages to capture these tenants,” CompStak wrote. Other bright spots in the office market similarly become less encouraging when viewed in context. The availability rate for office space in Manhattan dropped to 16.4 percent during the third quarter, the lowest since March 2021, according to Colliers. But that was still nearly two-thirds greater than at the start of the pandemic. Uncertainty about future demand, along with rising interest rates and construction costs, are strong disincentives for initiating an office project. Varuna Bhattacharyya, a commercial real estate finance attorney at Bryan Cave Leighton Paisner, said lenders seem willing to back renovations of Class A office stock, but have far less appetite for building it. “There are some lenders who won’t touch office at all, even those trophy assets,” she said. Christopher Coiley, who heads commercial real estate for Valley National Bank in New York, New Jersey and Pennsylvania, said lenders are demanding that sponsors put more equity than usual into projects, even if they are significantly pre-leased. And for the most part, banks are only working with extremely well-heeled sponsors. “[With] office, specifically, people are being more gun-shy,” Bhattacharyya said. “If you are not in that very top echelon, it is a struggle.” Out the gate At the ribbon-cutting ceremony for 425 Park Avenue, the developers of the office tower emphasized the importance of in-person collaboration in fostering company culture, which helps firms compete for employees. “You cannot create a culture remotely,” L&L Holding’s David Levinson said at the October event. Such marketing is to be expected from investors in office projects too far along to turn back. The redevelopment of 425 Park has been nearly two decades in the making and secured its anchor tenant, Citadel, in 2016. But they have reason to be hopeful. Companies have shown a willingness to commit to long-term deals in new offices: KPMG is trading space in three older offices for a 20-year lease at Brookfield Properties’ 2 Manhattan West. Still, it remains to be seen if demand will be enough to encourage new development. Miles Borden, of law firm Seyfarth Shaw, said it is difficult to envision major projects taking off in the next six to nine months, or however long it takes the capital markets to find better footing. Some developers may not have a choice, though. “You spent money, you bought your development site, you have investors who want to see returns — that changes the algorithm a bit,” he said. “I think [those developers] might, to the extent that they can, pause, to see what tenant demand is going to be.” Borden thinks it will take another two years or so for the future of office work to become clear. He is not alone in that view. “A lot of the developers are now really sharpening their pencils, or shelving it,” said Valley National’s Coiley. “We are seeing clients go through the process, but I would not say it is fast and furious. They are going through it hoping that the market settles down a bit.” Rich Bockmann contributed reporting.

Real estate’s wish list: Industry’s priorities for 2023

Nearly a year ago, Gov. Kathy Hochul proposed zoning changes and property tax incentives as part of her state budget. To the dismay of the real estate industry, most of that housing agenda flopped. But the industry has its sights on some of the same proposals and others heading into the 2023 legislative session, which starts early next month. A major priority is the replacement of the expired property tax break, 421a. Hochul has said she is committed to addressing this issue next year, though her previous proposal to replace the program proved a non-starter for lawmakers. However, efforts to build housing and reform property taxes have since gained momentum. The landlord group Community Housing Improvement Program last week released its lobbying agenda for the state legislative session. The group is working on suggested bill language for a “vacancy reset” — allowing building owners to raise rents when a stabilized apartment is vacant. CHIP argues that the change is needed because the 2019 rent law rendered tens of thousands of apartments unrentable by ending vacancy decontrol and severely restricting rent increases to pay for renovations. The Rent Stabilization Association, which teamed up with CHIP to wage a legal challenge against the state’s rent stabilization system, has not released a formal agenda. However, Frank Ricci, RSA’s executive vice president, agreed that something needs to be done to allow landlords to pay for apartment renovations. “One way or another, there needs to be a serious conversation with the people who know how to do this kind of work and the people in the legislature to get those apartments habitable,”he said. He added that RSA supports increasing funding for the state’s housing courts and will continue to oppose good cause eviction bill that would protect tenants against rent increases higher than 3 percent, or 150 percent of the inflation rate, whichever is larger. “It will continue to be a priority for us to ensure it is never enacted,” Ricci said. Newburgh’s version of good cause was struck down by a judge last month, leaving statewide legislation as its backers’ most feasible route. Potential common ground for the industry and tenant advocates may be a Housing Access Voucher Program, a state-funded initiative akin to federal Section 8. The Senate and Assembly showed support for a $250 million program, but it was not ultimately included in the budget. CHIP referred to it as “thoughtfully designed,” noting that it would give tenants more flexibility in choosing where they want to live. “It is also designed to give owners more certainty that the voucher would be paid by the government without delay,” CHIP said in a release. The Real Estate Board of New York has not revealed its agenda for the session, but the trade group indicated that it is focused on a variety of tools, including a replacement 421a, to promote housing creation and the recovery of the city’s economy. The industry has also backed a proposal to lift the city’s cap on the residential floor-area ratio, or FAR, and zoning changes to ease the conversion of empty office space into housing. CHIP also supports the legalization of accessory dwelling units and removing parking requirements for certain projects Hochul signaled Thursday that housing will be central to her policy agenda next year. “We’re a national leader in blocking housing,” she said at a New York Housing Conference event. “New York is in a league of its own in terms of restricting new housing.” The audience greeted the line, which few politicians have had the courage to say, with spontaneous applause. For Hochul and the landlords groups, writing the bills will be the easy part. Building public support sufficient to persuade legislators is another story, although it will be easier next year than in 2022, which was an election year for all state lawmakers. “Every town, every planning board, every zoning board has a role to play,” the governor said, calling for an education campaign to “change their mindset.”

Categories

Recent Posts