Icon lands a $57M lunar construction deal with NASA

The moon may be the next hot real-estate development opportunity. Austin-based 3D home printing company Icon won a $57.2 million contract with NASA to develop technology to help build lunar infrastructure like roads, landing pads, and habitats, according to a press release. The contract runs through 2028, and expands upon other Icon partnerships with the federal government to develop the company’s Olympus construction system. To avoid importing building supplies from Earth, Olympus is designed to use construction materials on the moon and Mars. “In order to explore other worlds, we need innovative new technologies to those environments and our exploration needs,” Niki Werkheiser, director of technology maturation in NASA’s Space Technology Mission Directorate, said in a statement. Icon’s other work with NASA includes Mars Dune Alpha, a 1,700-square-foot 3D-printed Martian habitat that will be employed in the space administration’s Crew Health and Performance Analog mission next year. The construction technology startup raised $185 million in a funding round that closed in February, bringing its total funding to $451 million. An anonymous source told TechCrunch at the time of the funding round the company was estimated to be worth $2 billion. Icon debuted America’s first permitted 3D-printed home in 2018, just one year after the company was founded. Last October it announced a partnership with homebuilding giant Lennar to develop a community of 100 3D-printed homes in Austin. The first home in the project debuted in March, featuring the 2,000-square-foot “House Zero,” and a 350-square-foot guest house, which took just eight days to build with the firm’s Vulcan technology.

Three US casino companies receive tentative renewals in Macau

Three major casino companies are among those to have their licenses renewed in Macau, but the government expects them to push more of their chips into diversifying the local economy. The coastal Chinese region renewed the licenses of Las Vegas Sands, Wynn Resorts, MGM Resorts and three Chinese companies, the Associated Press reported . The renewed licenses take effect at the start of next year, but final terms for the renewals haven’t been set. There is an expectation the casino companies will invest in non-gambling attractions in the region, one of the world’s most tourism-dependent economies. TDM Radio Macau previously reported the casino companies are expected to invest a cumulative $12.5 billion. Foreign-owned casinos proved to be a boon in Macau when they were permitted two decades ago, operating 41 casinos across the city. In 2013, annual revenue from slot machines, dice tables and more hit $45 billion, tripling the revenue of Las Vegas, the United States’ biggest gaming hub. But China tightened regulations on mainland gamblers visiting Macau, bringing revenue down. The pandemic did no favors for the local government, as gambling revenue was only $7.6 billion in 2020 and $10.8 billion in 2021. Chinese president Xi Jinping is pushing for the Macau economy to diversify and become less reliant on gambling. More retail and entertainment venues would presumably help the region withstand any future decline in gambling and would more closely mirror Las Vegas, which is known for its casinos but has plenty of family-friendly options as well. SJM Holdings, which had a four-decade monopoly on casinos in the region before it was opened up, has indoor skydiving and a zipline in Macau. Other efforts to bring diverse entertainment options to Macau, however, including an “Avatar” theme park and a Hello Kitty theme park, have fallen by the wayside.

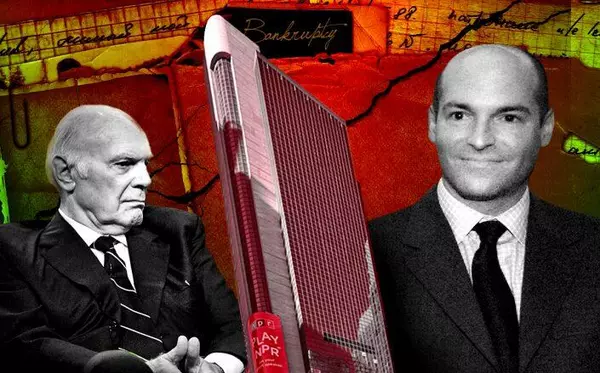

Developer pays $40M for Colorado estate with two shooting ranges

A massive Colorado estate with its own ice cream parlor, two shooting ranges and cowboy saloon sold for $40 million, in one of the most expensive home sales in the area. S. Robert Levine, the eccentric founder of New Hampshire-based Cabletron Systems, a 1980s and 1990s computer networking company, sold the almost 450-acre property near Vail to a real estate developer that plans to subdivide the property into eight to 10 home parcels, the Wall Street Journal reported. Florida-based Baseline Property Group, led by Brock Nicholas and Stephen Lobell, is the buyer, while Malia Cox Nobrega and Barbara Gardner Scrivens of LIV Sotheby’s International Realty were the listing agents for the property, which had been listed for $42 million. The property is located in the unincorporated town of Edwards, which is on the northern edge of the White River National Forest. The 30,000-square-foot main house has eight bedrooms, a saloon and an ice-cream bar with booth seating. There is also a 28,000-square-foot entertainment center called the Coyote Lodge that has an indoor swimming pool, Japanese-style teppanyaki dining area and climbing wall. The property features a 200-foot steel viewing bridge suspended over the forest below as well as several guest cottages and apartments on the property. There is also an Old West-style town with a hitching post and a sheriff’s office with a jail, soccer fields, and a trout-stocked pond. Baseline reps say they plan to keep the Coyote Lodge entertainment building as an amenity for future residents and keep the main house for personal use. They said they expect to sell the home lots for a combined $45 million to $50 million. The Vail-area home sale record was set in 2020 when Kevin Ness, the CEO of biotech company Inscripta, bought a home for $57.25 million.

Categories

Recent Posts