Brookfield gets Ritz-Carlton SF in $3.8B deal for Watermark

Brookfield will acquire the Ritz-Carlton hotel in Downtown San Francisco as part of its $3.8 billion acquisition of hotel REIT Watermark Lodging Trust.

The Toronto-based developer recently announced it would buy Watermark’s 25 hotels across the U.S., a portfolio that totals more than 8,100 keys.

One of those hotels is the 336-key Ritz-Carlton San Francisco, located at 600 Stockton Street, just half a mile from Union Square, though it’s unclear how much Brookfield will pay per key for the hotel. The deal is expected to close in the fourth quarter.

Watermark investors bought the hotel for $231 million in 2016, or around $687,800 per key, financial filings show. Watermark Lodging Trust took control of the five-star property in April 2020, when the company was formed through a merger of Carey Watermark affiliates.

Watermark most recently refinanced the Ritz-Carlton San Francisco in November, with a $149 million mortgage loan from MetLife, public property records show.

The San Francisco Ritz-Carlton currently has a book value of $216 million, or around $642,900 per key, according to the company’s most recent annual financial report. Book value refers to how much money shareholders would receive for the property if all assets were liquidated and liabilities were paid off, rather than what the market is willing to pay for a property.

Moody’s recently valued the Westin St. Francis — a four-star hotel in Union Square — at $298.8 million, or about $250,000 per room. That valuation was a significant cut from the owner’s — a successor to the now defunct China-based insurance provider Anbang — own valuation of $436 million.

Moody’s cited “significant uncertainty” around whether the Westin would rebound after the pandemic, given its past reliance on business and international travelers, as reasoning for its lower valuation.

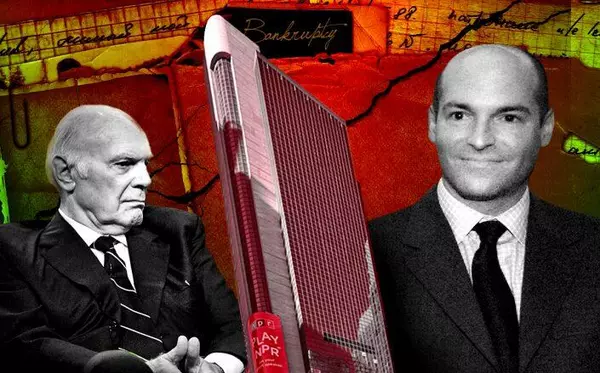

On a recent earnings call, Starwood Property Trust CEO Barry Sternlicht called San Francisco “the worst hotel market in the United States by 1 million miles,” adding the market will mostly remain “very challenging.”

Categories

Recent Posts

GET MORE INFORMATION